Kenya, like many countries in the global south, is actively pursuing decarbonization to address climate change. The transport sector is a significant contributor to greenhouse gas emissions, accounting for approximately 20% of total global carbon emissions, with road transport alone responsible for 75%, equating to 3 billion metric tonnes annually.

In Kenya, the adoption of electric mobility faces several challenges that impede progress. These include inadequate infrastructure, regulatory gaps, low public awareness, and a shortage of skilled personnel. As the urgency to combat climate change intensifies, transitioning to e-mobility becomes crucial for reducing carbon emissions and promoting sustainable transportation. However, these obstacles threaten to undermine Kenya’s efforts to embrace this vital shift.

This paper employs a mixed-methods approach, integrating quantitative data from the Ministry of Roads and Transport, the Kenya Bureau of Standards (KEBS), the Energy and Petroleum Regulatory Authority (EPRA), Kenya Power and Lighting Company (KPLC), and the National Transport and Safety Authority (NTSA) with qualitative insights gathered from expert interviews and further enriched by secondary sources from academic literature. To facilitate the adoption of e-mobility, the paper recommends that the government should enhance its legal and regulatory frameworks, invest in comprehensive charging infrastructure, and implement robust public awareness campaigns. By collaboratively addressing these challenges, Kenya can create an environment conducive to e-mobility adoption, ensuring economic growth while contributing to global sustainability efforts.

Introduction

As the global community intensifies its efforts to address climate change, e-mobility has emerged as a transformative solution for sustainable transportation and climate change with forecasts predicting a market share of 30% by 2030 (IEA, 2024). In alignment with this global trend, Kenya is making significant progress toward achieving carbon-zero public transport, driven by the need to address critical environmental and health challenges.

Globally, the transport sector is a major emitter of greenhouse gases, responsible for approximately 20% of total carbon emissions. Road transport alone contributes 75%, amounting to 3 billion metric tonnes annually.[1] This is seven times the emissions produced by the aviation sector. Transportation is a significant contributor to air pollution in Kenya. The sector predominantly relies on aging, inefficient, and poorly maintained vehicles, which emit substantial levels of pollutants into the atmosphere. Notably, the transport sector is responsible for approximately 25% of the country’s carbon dioxide emissions, a primary greenhouse gas driving climate change. A report by the United Nations Environment Programme (UNEP) highlights that the transport sector in Nairobi alone contributes around 60% of the city’s air pollution.

Transitioning from fossil fuel-powered vehicles to electric transport in Kenya presents significant advantages, particularly in terms of cost savings and job creation. The shift to electric vehicles (EVs) is projected to reduce service and fuel costs by 50-80% compared to traditional vehicles, making public transport more affordable and sustainable. The National Energy Efficiency and Conservation Strategy (2020) targets that 5% of all newly registered vehicles in Kenya should be electric-powered by 2025. For these targets to be achieved there should be interventions in reliability of power supply, charging facilities, affordability and quality of the EVs. It is important for scholars to debate technical and policy issues affecting the sector, to guide decision makers to come up with informed strategies.

This policy brief explores the key gaps in Kenya’s effort to transition to e-mobility and offers actionable recommendations to facilitate a seamless shift towards a more sustainable and efficient transportation system. It also aims to provide valuable insights for policymakers, industry stakeholders, and the public, ensuring that Kenya fully capitalizes on the benefits of electric mobility while advancing its climate and economic goals.

Methodology

This policy brief adopted a mixed-methods approach. It combined qualitative and quantitative data collection methods to provide a comprehensive analysis of Kenya’s e-mobility landscape. Quantitative data was sourced from key government agencies, including the Ministry of Roads and Transport, the National Transport and Safety Authority (NTSA), Kenya Power and Lighting Company (KPLC) and the Kenya Bureau of Standards (KEBS) reports. This data offered insights into the current status of electric vehicle registrations, infrastructure availability, and adherence to existing standards. Qualitative data was obtained through expert interviews conducted virtually and in person which provided a deeper understanding and context to the quantitative findings. Secondary data from books, academic journals, and newspaper articles was reviewed to enrich the analysis. The collected data was analyzed thematically to identify key patterns, trends, and insights.

The current status of E-mobility In Kenya

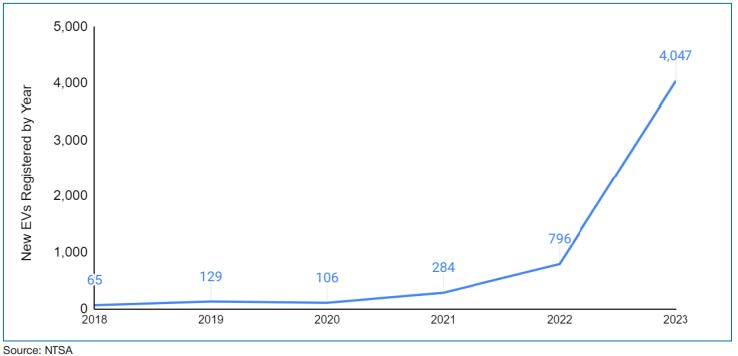

In Kenya, the journey towards e-mobility is gaining momentum. As of 2023, Kenya’s E-mobility market experienced rapid expansion with a growing presence of electric bicycles, motorbikes, tuk-tuks, passenger cars, buses, and specialized equipment such as forklifts and tractors. During this period, the sector witnessed a remarkable growth, with newly registered electric vehicles increasing from 65 units in 2018 to 4,047 units in 2023 which includes unregistered e-bicycles. This represents over 2.4% of all new vehicles sold in Kenya in 2023, according to NTSA data (2018 to 2023) as shown in figure 1 below; [2]

Figure 1: New electric vehicle registration statistics (2018 – 2023)

| New Electric Vehicle Registration Statistics by Vehicle Classification (2018-2023) | ||||||

|---|---|---|---|---|---|---|

| Type of Vehicle | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Electric Bicycles | 321 | 1,353 | ||||

| Electric Motorcycles | 44 | 96 | 28 | 144 | 366 | 2,557 |

| Electric Tuk Tuk | 4 | 21 | 35 | 40 | 39 | |

| Electric Passenger Cars | 12 | 15 | 31 | 62 | 36 | 45 |

| Electric Buses & Mini Buses | 3 | 18 | ||||

| Electric Other Vehicles | 9 | 14 | 24 | 43 | 30 | 35 |

| Total Vehicles Registered | 65 | 129 | 104 | 284 | 796 | 4,047 |

Source: NTSA data 2018-2023

Table : New electric vehicle registration statistics by vehicle classification (2018-2023)

As illustrated in table 1 above, the current adoption rate is relatively low but is increasing rapidly, reflecting the significant impact of fiscal incentives introduced in the Finance Bill 2023. Although EVs comprised less than 0.1% of new vehicle registrations from 2018 to 2022, this proportion surged to over 2.4% in 2023. The increase is even more pronounced when excluding unregistered e-bicycles, with electric motorcycles accounting for 1.6% of new vehicle registrations. Key measures contributing to this surge include the introduction of the e-mobility tariff, a reduction of excise duty on EVs from 20% to 10%, and the exemption of fully electric cars from Value Added Tax (VAT). These initiatives have significantly enhanced the attractiveness of EVs, driving a marked increase in their adoption and contributing to a promising upward trend in the Kenyan automotive market.

The growth is particularly notable in specific sub-sectors: electric bicycles, which saw annual sales rise from 0 to 1,353 units in just two years, and electric buses, which grew from 0 to 18 units over the same period. The electric motorcycle sector, the fastest-growing and largest EV sub-sector, represented over 3.3% of all new motorcycle registrations in 2023 and over 10% in Nairobi. Notably, Ecomobilus Technologies Limited is advancing the sector further with the development of an electric handcart-mkokoteni. This concentration in Nairobi is attributed to the strategic deployment of charging infrastructure, battery swapping stations, and service facilities.

Despite these advancements, Kenya continues to face significant challenges. The transport sector, which emitted 12.3 million tons of carbon dioxide in 2019, highlights the urgent need for cleaner alternatives. With approximately 68.1% of Kenyans relying on public and non-motorized transportation, according to the 2019 Kenya Population and Housing Census, the potential for e-mobility to provide substantial environmental and economic benefits is considerable. Strategic investments in electric two-wheelers and high-capacity buses, coupled with supportive policies, have the potential to transform Kenya’s public transport sector and advance national climate objectives.

Key Findings

The adoption of electric mobility in Kenya faces several significant gaps. The following factors emerged as the primary issues hindering progress in this sector

a. Inadequate Charging Infrastructure

The transition to e-mobility in Kenya is significantly impeded by the infrastructure deficiency, which is essential for supporting the increasing number of electric vehicles and other electric modes of transport. Despite the provisions of the Energy Act of 2019 that mandated the development of energy infrastructure, the country had only 29 charging stations as at March 2022.[3] Most of these charging stations are Level 2 chargers, which operate at 240 volts compared to standard wall sockets that provide 120 volts. For instance, a Nissan Leaf-a popular EV model requires approximately three hours to recharge using a Level 2 charger. With these limited numbers of charging stations, then this calls for long queues at the charging stations. The limited number of charging stations results in long queues, contributing to significant range anxiety among potential EV users and deterring adoption, which prevents the sector from reaching its full potential. This scarcity can be attributed to various factors, including unreliable electricity supply and high infrastructure development costs.

i. Unreliable and Expensive Electricity

Kenya’s electricity infrastructure poses additional hurdles. Approximately 29% of the population lacks access to electricity, with the situation being more severe in rural areas where 47% are without power.[4] The unreliable and intermittent electricity supply, characterized by frequent power outages affecting nearly 50% of grid connections, disrupts the charging process and reduces the convenience of using electric mobility technologies. In addition, the cost of electricity for EV charging stations remains high. As of April 2023, Kenya Power introduced a special tariff rate of KES 16 (approximately USD 0.12) per kilowatt-hour (kWh) during peak periods and KES 8 (approximately USD 0.058) per kWh during off-peak periods.[5] Despite these rates being somewhat lower than those for commercial and industrial uses, the overall cost to consumers is inflated by VAT and other levies further complicating the economic viability of EM charging.

ii. High Capital Investment required in setting up charging station

Establishing EV charging infrastructure involves considerable financial outlay. For instance, a Level 2 charger will cost between $1,000 and $5,000, while a Level 3 charger the fastest and most powerful option can cost up to USD 80,000.[6] Although less expensive wall chargers, suitable for home or private use, are available for as low as USD 800, the overall expense of building a comprehensive charging network remains prohibitive. This includes site acquisition, construction, equipment, installation, and ongoing operational and maintenance costs. Against this backdrop, there has to be demand for supply to be met. There is need for sufficient demand for EVs to incentivize private sector investment in charging stations.

Currently, Kenya imports a substantial portion of its power from Uganda and Ethiopia. Despite relying heavily on renewable sources, the country’s power reliability remains a concern. As of 2023, Kenya has seen fluctuations in System Average Interruption Frequency Index (SAIFI) values, with reports indicating an increase in outages. The SAIFI is the average number of interruptions that a customer experiences over a specific period (usually a year). For instance, the SAIFI value rose from 2.25, 2.2, 3.2 and 4.058 from 2020 to 2023. SAIFI value should be less than 1. This then reflects growing challenges in the electricity supply system due to ageing infrastructure, demand-supply mismatch problems, technical faults within the generation and transmission systems as well as maintenance and upgrading challenges.

Kenya’s energy sector relies heavily on renewables such as geothermal and wind energy. Nonetheless, more than 84% of electricity generation in the country is renewable. The question is not entirely on power sufficiency but in whether the national grid is fully optimized for integration with electric mobility charging infrastructure. Another critical area of concern is interoperability among charging ports. Different manufacturers, including those from Japan and China, utilize varying adapters, which can lead to compatibility issues. Some adapters may be loose or poorly designed, resulting in slow charging or, in some cases, no charging at all. The lack of standardization exacerbates these challenges.

b. Regulatory Framework and Policy Coordination

The Kenya Kwanza manifesto outlines ambitious plans for advancing e-mobility in the country, including the rollout of electric vehicle charging infrastructure in urban areas and along highways. It also emphasizes the provision of financial and tax incentives for public service vehicles and commercial transporters to convert to electric vehicles. Furthermore, the government aims to leverage support for the boda boda sector through the Hustler Fund to develop the nascent EV motorcycle assembly industry.

However, the effective implementation of these initiatives faces significant challenges within the regulatory framework, particularly due to the lack of consideration for county governments in the regulations. Specifically, while county governments are recognized in the constitution, policies, and Acts of Parliament, their roles are not adequately addressed in the regulatory framework.

The draft status of the National E-Mobility Policy, launched in March 2024, is hindered by significant gaps that could undermine its effectiveness. A primary concern is the lack of coordination among stakeholders, complicating efforts to implement a cohesive e-mobility strategy. Various government agencies, private sector actors, and civil society organizations often work in silos, making it difficult to establish a unified approach. Without clear communication and collaborative initiatives, efforts to promote electric vehicles risk becoming disjointed and ineffective, thereby limiting the potential for impactful solutions.

The draft policy outlines certain responsibilities for county governments, particularly in terms of infrastructure support. This includes collaboration with the national government to establish charging ports. However, the policy could go further by expanding the role of county governments to include setting up facilities for manufacturing electric vehicle components, such as batteries and motors. Despite these aspirations, the policy falls short in addressing the financial and human resource capacity needs of county governments. While the national government may have adequate staffing and resources, county governments often lack the necessary capacity. The policy should explicitly focus on building this capacity. Notably, during stakeholder engagement sessions in Kisumu County, concerns were raised about county governments’ limited ability to understand their roles as outlined in existing policy frameworks.[7]

The high cost and inconsistent reliability of electricity are key barriers to the adoption of e-mobility, which the draft policy rightly identifies. Proposed solutions include revising tariffs for EV charging and enhancing reliability through decentralized energy systems. Stakeholders in Kisumu further recommended the integration of solar PV plants to support the grid for EV charging. However, the policy fails to incorporate this option of distributed energy generation as part of the charging infrastructure.

Further, the policy does not address the electrification of rail transport, despite earlier commitments to electrify the standard gauge railway. Energy adequacy and reliability for powering trains should have been a critical consideration within the document.

While the policy focuses on transitioning public service vehicles from fossil fuel engines to electric alternatives, it outlines a phased approach for this shift. It acknowledges the high cost of EVs and underscores the importance of financing, incentives, and insurance for electric vehicles in public transport. However, the policy lacks specific guidance on how county governments can contribute to or facilitate this transition.

Finally, the draft policy does not fully align with other key national policies related to energy, transport, and environmental sustainability, such as the Integrated National Transport Policy. A lack of coordination in the planning and management of transport systems persists, with transport planning centralized at the national level, even though county governments oversee 72% of the roads. While the draft policy proposes a coordination framework, it does not clearly define the role or participation of county governments. Historically, transport planning has focused heavily on road infrastructure and traffic management, often neglecting the critical issue of energy access needed to power vehicles. This omission limits the policy’s ability to promote sustainable transport across national and county levels.

c. Importation Hurdles

A significant barrier to e-mobility adoption in Kenya is the high upfront cost of EVs, which can be up to twice as expensive as fossil fuel-powered vehicles, according to the 2021 The Association for Electric Mobility & Development in Africa (AEMDA) Market Survey. This is compounded by high import duties and excise taxes and limited understanding of CRSP/HS Codes.

i. Import Duties and Excise Taxes

High import and excise taxes continue to pose significant challenges to the cost of e-mobility in Kenya. Despite the Finance Act of 2023 reducing VAT for most EVs categories, the East African Community (EAC) exemption led to an increase in import duties to 35% for cars, buses, and goods-carrying vehicles. This heightened duty imposes a substantial financial burden on EV importers, potentially deterring investment and stifling growth within the sector. Compounding these difficulties, the Finance Bill 2024 proposed a 16% VAT on the supply of electric buses, marking a substantial regression in efforts to promote e-mobility. However, in response to widespread concerns, this bill was ultimately withdrawn, leaving the proposed VAT increase unimplemented.

In contrast, Ethiopia has embraced a proactive approach to e-mobility, implementing a range of incentives to facilitate a transition to 100% electric mobility. The Ethiopian government enacted policies that include a 0% import duty on electric vehicles and a five-year VAT waiver for newly registered EVs. These measures are part of a broader strategy aimed at electrifying public transportation and reducing greenhouse gas emissions. As of 2023, approximately 12% of Ethiopia’s public transport fleet was electric, with ambitious plans for further increases in the near future. This commitment has positioned Ethiopia as a regional leader in e-mobility.

ii. Limited Understanding of CRSP/HS Codes

The Kenya Revenue Authority (KRA) encounters significant hurdles in accurately identifying and taxing EVs due to a limited understanding of Current Retail Selling Prices (CRSP) and Harmonized System (HS) codes. CRSP refers to the expected market price of a vehicle, while HS codes are standardized classifications used internationally to categorize products for taxation purposes. The KRA often applies a higher CRSP than what is stated on invoices, particularly for used EVs, resulting in inflated tax burdens for importers and complicating the financial viability of importing these vehicles.

Importers and assemblers face considerable uncertainties and delays at the port of entry due to an ambiguous tax framework that currently recognizes only the Nissan Leaf as an official EV model. A manual input for CRPS is required for any other EV. This lack of clarity not only raises operational costs but also disrupts supply chains, affecting the timely availability of vehicles in the market. Further, the existing CRSP template does not accommodate electric two-wheelers or a variety of other EV models, leading to confusion regarding the applicable duties, taxes, and exemptions for these vehicles.

d. Skills Gap

The transition to EVs and related technologies requires a specialized workforce trained in the design, manufacturing, maintenance, and repair of EV technologies. However, Kenya lacks a robust educational and technical framework to produce such skilled professionals. A report by the International Renewable Energy Agency (IRENA) published in 2022 indicated that Africa needs to train an additional 2 million people in green energy technologies by 2030 to meet the continent’s renewable energy goals, with e-mobility forming a critical part of this transition. In Kenya, the absence of EV-related programs in technical institutes and universities exacerbates this gap which slows down the local industry’s growth. For instance, only a handful of certified technicians are capable of working on electric vehicles, while most mechanics are still trained in internal combustion engine (ICE) technologies.

e. Low Public Awareness on E-mobility

In Kenya, there is a notable preference for traditional vehicles over emerging e-mobility options. This preference highlights a significant level of skepticism and low awareness about e-mobility solutions. There is limited awareness about the cost-effectiveness, social benefits, and practical advantages of these electric alternatives. E-mobility solutions offer substantial long-term savings through reduced maintenance and operational costs and contribute to reducing government reliance on imported fossil fuels, which helps to mitigate price volatility.

A survey conducted by the global technology company Epson in 2023 found that 72.1% of Kenyans are willing to invest in electric mobility solutions, including e-bikes and e-motorcycles, to address climate change. However, despite this willingness, the National Transport and Safety Authority (NTSA) face significant challenges in promoting e-mobility effectively. These challenges are primarily due to sporadic and inadequately funded public awareness campaigns, as detailed in the Draft National E-Mobility Policy. The Finance Act of 2023, which had the potential to allocate substantial resources for e-mobility education and infrastructure development, prioritized other sectors, leaving e-mobility initiatives under-resourced.

Conclusion

To achieve a sustainable and inclusive transition to e-mobility, Kenya must undertake comprehensive and strategic actions that address the multifaceted challenges facing the sector. Despite progress made through policies like the Draft National E-Mobility Policy and incentives outlined in the Finance Act of 2023, significant gaps persist, including infrastructure deficiencies, a fragmented regulatory framework, high importation costs, low public awareness, and skills gap. To realize the full potential of this sector, collaborative efforts from both national and county governments are essential to enact the pending frameworks, strengthen county capabilities, and ensure ongoing collaboration. There is an urgent need for a robust network of charging stations and a consolidated regulatory environment that facilitates the adoption of electric vehicles. Addressing financial barriers is essential to deter the high importation costs that currently hinder growth. Increasing public awareness of the benefits of e-mobility will encourage adoption, while developing a workforce equipped with the necessary skills will ensure sustainability in the sector.

Recommendations

Long-Term

- The Ministry of Road and Transport and the Ministry of National Treasury and Planning should expedite the finalization and enactment of the National E-Mobility draft policy. This comprehensive policy instrument will support the development of charging infrastructure, encourage local manufacturing, and introduce targeted tax incentives.

- The Ministry of National Treasury and Planning, The Ministry of Road and Transport and EPRA should establish a revolving fund to support county governments in financing e-mobility initiatives. The fund could be administered through a pay-as-you-go financing system for public transport operators. It could also be utilized to provide subsidies for the purchase of electric two- and three-wheelers at the county level. The fund should further support structured capacity-building programs, led by the national government, to strengthen the capabilities of county government staff.

- The Ministry of Education should prioritize integrating electric mobility technologies into the national curriculum, emphasizing capacity building through Technical and Vocational Education and Training (TVET) institutions. Establishing internships and training programs in collaboration with industry stakeholders will ensure a skilled workforce to support the growth of the e-mobility sector.

Medium-Term

- EPRA and Energy Companies should collaborate in setting operational and safety standards and investing in battery-swapping infrastructure. EPRA will ensure regulatory compliance, interoperability across electric vehicle models, and streamline the licensing process. Meanwhile, energy companies can leverage their existing fuel station networks to incorporate battery-swapping facilities.

- The Supreme Court of Kenya should prioritize its proceedings regarding the Finance Act 2023 to clarify the legal status of the Act, particularly concerning e-mobility measures. This clarity is essential for fostering investment and ensuring confidence in the regulatory framework for electric vehicles in the country.

- Collaboration between the Ministry of Land, KENHA, KURA, KPLC, and EPRA is needed to ensure land availability on road reserves and adequate power supply for charging stations.

Short-Term

- The Ministry of National Treasury and Planning should review and adjust import duties and streamline registration for electric vehicles. Reducing these duties and providing clearer classifications for EVs will lower financial burdens on importers and support sector growth, akin to successful strategies in Ethiopia.

- KRA in collaboration with NTSA to ensure more accurate and fair taxation by improving the understanding of CRPS and HS codes, as well as incorporating a wider range of EV models in the HS Code.

- Research institutions should actively publish papers and books focused on electric mobility to enhance consumer perception and confidence in the sector. These publications will serve as valuable resources, educating potential consumers and lenders by disseminating data and insights on market trends, risk assessments, and successful case studies related to the benefits and viability of electric vehicles.

- The Ministry of Energy and Petroleum (MoEP), the Energy and Petroleum Regulatory Authority (EPRA), county governments, non-governmental organizations, academia, and the Electricity Sector Association, should review the energy policy to align it with emerging trends and technologies. This review should focus on assessing the status and potential role of green hydrogen in the electricity and transport sectors. This should include the development of policies and strategies to promote its adoption.

References

Alanazi, F. (2023). Electric vehicles: Benefits, challenges, and potential solutions for widespread adaptation. Applied Sciences, 13(10), 6016.

https://doi.org/10.3390/app13106016

Trends in Electric Light-Duty Vehicles—Global EV Outlook 2022—Analysis—IEA. Available online:

https://www.iea.org/reports/global-ev-outlook-2022/trends-in-electric-light-duty-vehicles (accessed on 15 April 2023).

Stockkamp, C., Schäfer, J., Millemann, J. A., & Heidenreich, S. (2021). Identifying factors associated with consumers’ adoption of e-mobility—A systematic literature review. Sustainability, 13(19), 10975. https://doi.org/10.3390/su131910975

Ipsos. (2023, March). Why charging logistics and infrastructure could be a game changer in making electric vehicles more accessible. Ipsos.

ZE Mobility. (2023, August). Accelerating e-mobility in East Africa – A case for Kenya (Policy Brief).

Ali, Z. M., Calasan, M., Gandoman, F. H., Jurado, F., & Abdel Aleem, S. H. E. (2024). Review of batteries reliability in electric vehicle and e-mobility applications. Ain Shams Engineering Journal, 102442. https://doi.org/10.1016/j.asej.2023.102442

Prause, L., & Dietz, K. (2022). Just mobility futures: Challenges for e-mobility transitions from a global perspective. Futures, 102987. https://doi.org/10.1016/j.futures.2022.102987

John, L., Patro, R., Padmakala, S., & Madhumala, R. B. (2024). E-Mobility as a service and its economic impact: Regulations, policies, governance, and best practices in e-mobility ecosystems. In E-Mobility in Electrical Energy Systems for Sustainability (p. 23). https://doi.org/10.4018/979-8-3693-2611-4.ch003

Electric Mobility Taskforce, Kenya, Ministry of Roads and Transport. (2024, March). Draft National E-Mobility Policy, Kenya.

Republic of Kenya, Ministry of Industrialization, Trade, and Enterprise Development. (2022, February). Sessional Paper No. 01 of 2022 on National Automotive Policy. Nairobi: Government Printer.

https://www.transport.go.ke/dawn-new-era-ministry-launches-draft-electric-mobility-policy

Sheehan, C., & Green, T. (2023). ChargeUp! Kenya Charging Forward: A brief assessment of Kenya’s e-mobility policy landscape and proposed changes.

Mbandi, A. M., Malley, C. S., Schwela, D., Vallack, H., Emberson, L., & Ashmore, M. R. (2023). Assessment of the impact of road transport policies on air pollution and greenhouse gas emissions in Kenya. Energy Strategy Reviews, 49, 101120. https://doi.org/[DOI]

[1] Transportation emissions worldwide – statistics & facts

[2] https://changing-transport.org/wp-content/uploads/2023_IMPROVE_Kenya_Scoping-Report.pdf

[3] https://www.electricbee.co/charging-stations-in-kenya/

[4] Dubey, S., Adovor, E., Rysankova, D., Portale, E., & Koo, B. (2019). Access to electricity and clean cooking in Kenya based on the Multitier Framework survey and data analysis. World Bank Group.

[5] https://kam.co.ke/statement-on-proposed-power-tariffs-adjustment/

[6] Peng, Vanessa. “How much does a commercial ev charging station cost?” WattLogic, February. 15, 2023

[7] National policy recommendations: Accelerating the transition to 100% renewables in Kenyan counties July 2024