1.0 Introduction

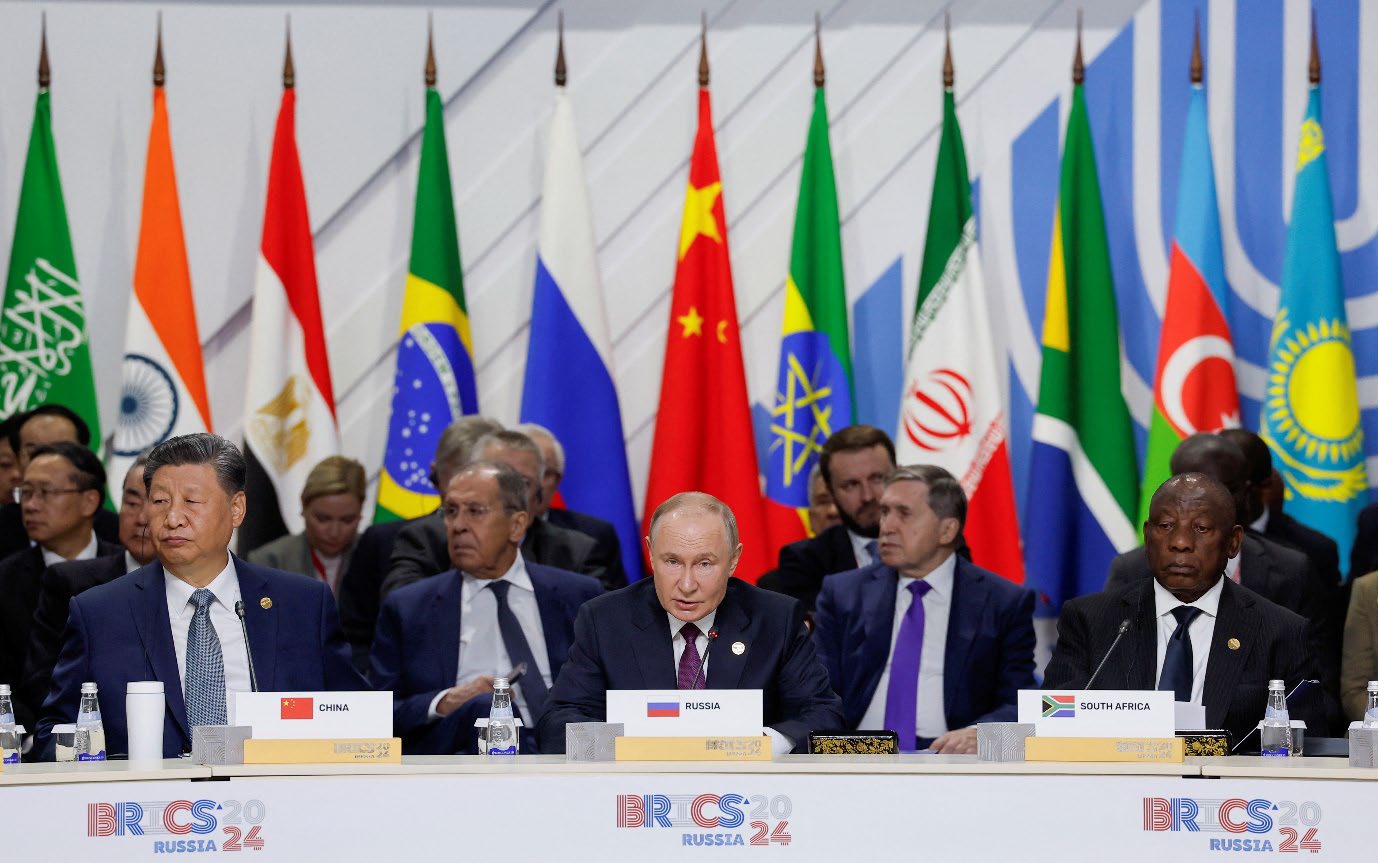

The 16th BRICS Summit, hosted in Kazan, Russia, from October 22-24, 2024, was a milestone within the shifting global power dynamics.[1] Under Russia’s chairmanship, the summit brought together a far larger and more diverse group of nations than ever before—a vivid symbol of BRICS’ growing clout and the rising stature of the Global South in the reconfiguration of world order. With its expansion to include Egypt, Ethiopia, Iran, and the UAE as full members, adding 13 other partner nations, BRICS has transformed into a much more formidable player in global politics and economics.[2] The theme of the summit, “Strengthening Multilateralism for Just Global Development and Security”, underlined BRICS’ overall goal: to create an alternative, multipolar world order where the interests of emerging economies and the Global South would come first.[3]

2.0 Key Issues

2.1 BRICS as a counterbalance to Western- Dominated Institutions

The heart of BRICS’ ambitions is the yearning for a more equitable global system that puts distance between itself and the long-standing dominance of Western-led international institutions.[4] The Kazan summit attested to the BRICS countries’ willingness to question the current global order—one that quite often works in favor of economic and political interests of the West, specifically of the United States and its European allies.[5] The very establishment of institutions like the United Nations (U.N), the International Monetary Fund (IMF), and the World Bank was based on the geopolitical realities of the post-World War II world, where the Western powers were overwhelmingly influential.[6] Now, with the rapid rise of emerging economies, BRICS is calling for a reform in global governance that will mirror the interests of the Global South.

The summit showed that BRICS is increasingly frustrated with these Western-dominated institutions and is going to create new frameworks for global governance. Russia’s proposal for the “BRICS Bridge” payment system is a direct challenge to the dominance of the U.S. dollar in international trade.[7] The system aims to create a digital, cross-border payment network for BRICS nations and their partners in an effort to conduct transactions free of reliance on the U.S. dollar or the SWIFT network, long used to monitor and control international financial flows.

This proposal is especially important because of the increasing clout of the U.S. dollar in global finance, which has enabled Western nations to impose economic sanctions and wield influence over the financial systems of other countries. Countries such as Iran, Venezuela, and Russia have experienced tremendous economic difficulties due to the sanctions that limit their access to dollar-based financial systems.[8] In developing an alternative payment system, BRICS is looking to insulate itself and its partners from Western economic pressure. While details surrounding the “BRICS Bridge” proposal are scarce at this point, it represents a significant tectonic shift both geopolitically and economically.

Another very significant issue that was discussed by the BRICS leaders at the Kazan Summit was that of de-dollarization, by developing national currency agreements for trade and investment. While this move to lessen dependence on the U.S. dollar may not threaten the dollar’s global dominance right now,[9] it does mirror a broader trend among emerging economies to diversify their financial relationships and decrease their vulnerability to external economic and political pressures.

Besides financing, BRICS’ focus is on the reform of multilateral institutions perceived to perpetuate Western hegemony.[10] For instance, the UN Security Council (UNSC) retains, in large degree, its tilt towards Western powers: nations with a permanent seat in the council—that is, countries like the United States, Great Britain, and France—are granted veto over important decisions. BRICS has long called for a more representative and inclusive Security Council, where countries from the Global South would have a significant influence.[11] While the Kazan Summit did not bring any concrete change in this regard, continued calls by BRICS for reforms in this respect point to a challenge facing the legitimacy of existing global institutional architecture.

2.2 The Attractiveness of BRICS for Countries of the Global South

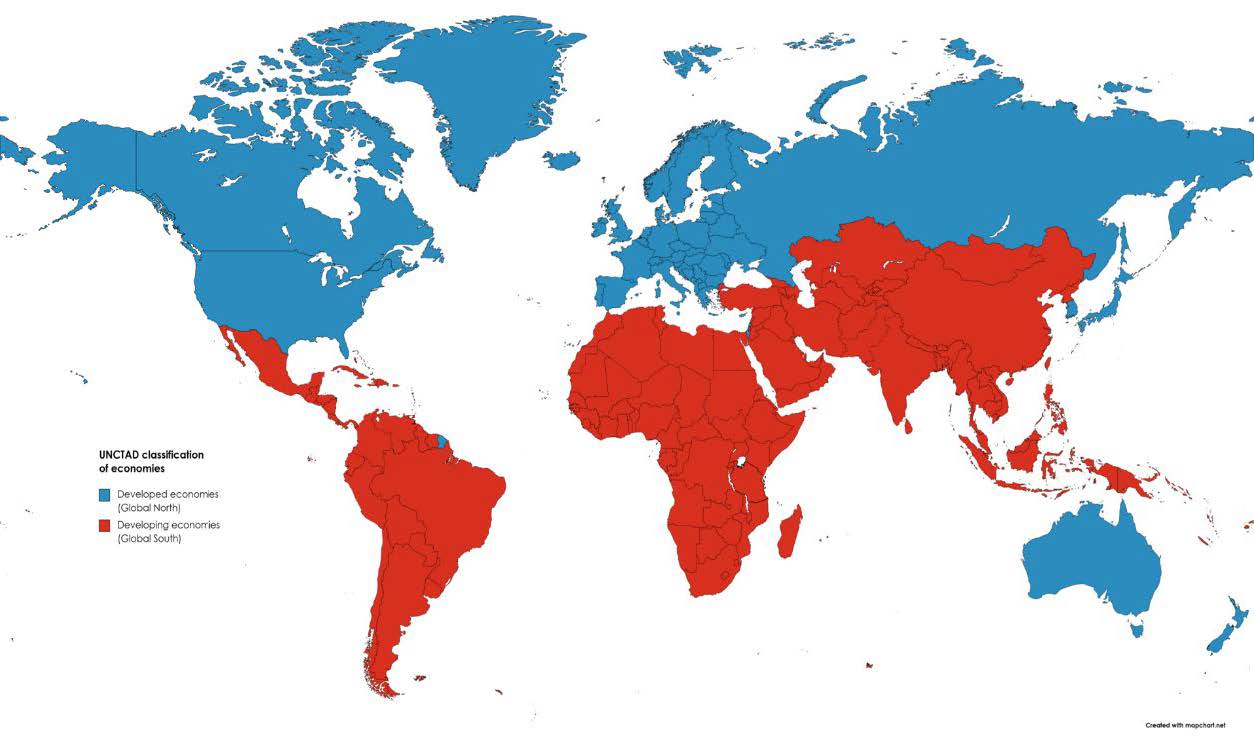

The increased attractiveness of BRICS stems from the need to have a bigger stake in the global governance system by the Global South countries. With the world’s economic and political power becoming more diffuse, countries in Africa, Latin America, Asia, and the Middle East are increasingly seeking to align with BRICS in efforts to secure a stronger foothold on the world stage.[12] The motivations for these countries to join BRICS are multifaceted, including economic opportunities, geopolitical leverage, and a sense of shared interests in resisting Western dominance.

2.3 Economic Opportunities and Diversification

For many countries in the Global South, one of the primary drivers of interest in BRICS is economic diversification. Many emerging economies have been highly dependent on Western markets for trade and investment, leaving them vulnerable to Western powers. Membership in BRICS offers new markets and investment opportunities within the bloc for these nations, which would significantly decrease their economic dependence on the West.

China and India are the two biggest members of BRICS and increasingly important players in global trade and investment.[13] As BRICS gains popularity, countries like Egypt, Iran, and Ethiopia look forward to tapping the economic potential of these major economies.[14] For instance, China’s Belt and Road Initiative has already been a game-changer for most of the states in Africa and Asia, where the majority of BRICS member countries have seen investments in their infrastructure, energy, and technology from China.[15] With BRICS strengthening its economic ties and advancing trade among member states, countries in these regions can look forward to benefiting from new avenues of trade and development financing.

Another economic benefit of BRICS membership lies in the impetus for putting in place financial mechanisms independent of Western control: The efforts that BRICS is making toward creating a payment system other than that run by the West, and the New Development Bank (NDB) that it has put in place, provide potential alternativesfor Global South countries from the unfavorable conditions that Western-controlled financial institutions like the IMF and World Bank have generally imposed on them.[16] These conditions have long been viewed as barriers to development, withcountries forced to implement neoliberal economic reforms not really suited to their specific contexts. On the other hand, BRICS places priority on an agenda of infrastructure investment, poverty reduction, and sustainable growth, which has a lot to do with the developmental priorities of Global South countries.[17]

2.4 Geopolitical Leverage and Autonomy

BRICS gives an important platform for countries to claim more geopolitical autonomy.[18] Many nations in the Global South are getting wary of being caught in the crossfire of the geopolitical rivalries between the West, China, and Russia. Joining BRICS provides a way for such countries to pursue a foreign policy that is more independent of traditional Western alliances.

For instance, the very fact of Türkiye applying for BRICS membership is a clear signal of Ankara’s desire to balance its geopolitical positioning between Russia, China, and the West.[19] A NATO member, Türkiye has long practiced “multivector” diplomacy, seeking to keep its relations with Western and non-Western powers positive. In a nutshell, by seeking membership in BRICS, Türkiye is signaling its need to be part of a bigger bloc that represents interests of the emerging economies and challenges the Western-led international order.

Similarly, the BRICS initiative has attracted many countries in Africa and Latin America because it gives them a chance to assert their political interests on the world stage. The issues of sovereignty, non-interference, and multilateralism are echoed by nations who feel sidelined by Western powers or, at the very least, in the throes of geopolitical influence. To countries like South Africa, Algeria, and Brazil, BRICS provides a platform through which the political and economic interests of the Global South can be pushed forward independently of the West.

2.5 Development and Infrastructure:

The other main reason why BRICS is so attractive to nations in the Global South is its commitment to development and infrastructure investment. In many regions, say, like Africa and South Asia, infrastructure deficits are one of the most critical hindrances to economic growth. BRICS has already committed considerable resources through the NDB toward funding infrastructure projects in member countries. It has the added advantage over Western financial institutions with regard to its lending practices in which development financing focuses on meeting developmental challenges faced by countries.[20]

The NDB has financed projects in the sphere of renewable energy, transportation, and technology that are crucial for building infrastructure in the BRICS countries for long-term growth. For instance, In Africa, the NDB in 2023 financed 13 sovereign and sub-sovereign projects sponsored by the South African Government and other South African borrowers. 11 of these projects are concentrated in such strategic sectors as the transport and clean energy sectors. In addition, the NDB has made two USD 1 billion loans through its COVID-19 Emergency Programme Loan. Furthermore, the NDB has provided financing for a 14th project that is a joint project between South Africa and Lesotho focusing on water resource management, supply and sanitation.[21] Unlike the traditional sources of funding, the IMF and the World Bank, which are always criticized for making austerity programs a condition of their loans, the NDB is quite flexible and supportive in its approach to lending to most of the developing countries.

2.6 The Geopolitical Implications of BRICS Expansion

The geopolitical implications of BRICS’ expansion cannot be overemphasized. The way in which BRICS has expanded its membership is going to recast the global balance of power, more so in those regions that have traditionally been within the sphere of influence of the Western powers. This signals a strategic realignment in global geopolitics as an expanded BRICS reaches out to the Middle East, Africa, and Latin America, where countries in these regions increasingly look to align with BRICS for better economic and political gains.

2.7 A Multipolar World Order

The rise of BRICS is emblematic of the ongoing tendency toward a multipolar world order, where the distribution of power is somewhat evenly spread among a number of different regions and blocs. By expanding, BRICS could accelerate the linking of countries from the Global South for greater cooperation on political, economic, and security issues. This multipolar order is in contrast to the unipolar world order that has been dominated by the U.S. and its allies since the end of the Cold War.

This shift toward multipolarity is particularly evident in the Middle East, where countries like Saudi Arabia, Egypt, and the UAE increasingly turn toward China and Russia. These countries are trying to diversify their alliances and decrease their dependence on the West, especially in the face of changed dynamics of global energy markets and changed security environment in the region. Membership of BRICS gives those countries a platform to advocate for their interests and reduce the geopolitical pressures by Western powers.

3.0 Conclusion

The growing influence of BRICS is creating a strategic dilemma for Western powers. For decades, the U.S. and its European allies have dominated global institutions, shaping key decisions in finance, trade, and security. However, with each expansion and new initiative, BRICS is pushing the world closer to a multipolar, competitive environment, shifting the balance of power away from the West.

One of the most immediate challenges is the potential erosion of the U.S. dollar’s status as the world’s reserve currency. While initiatives like the “BRICS Bridge” and alternative payment systems are still in early stages, they signal a significant move away from dollar dependence. Should these efforts succeed, it could weaken the West’s ability to leverage economic sanctions and exert financial influence globally, marking a shift in the global economic order.

BRICS’ expansion into areas traditionally dominated by Western powers raises important questions about the future of Western alliances and influence. As the group grows, it is poised to play an increasingly pivotal role in shaping global trade, security, and diplomatic norms. For the West, this means recalibrating its approach to international relations—not just through engagement with BRICS, but by forging new alliances and partnerships in response to the shifting global balance of power.

In this context, the rise of cryptocurrencies—such as Bitcoin—could play a transformative role in reshaping the global financial landscape. If cryptocurrencies gain wider adoption, they might further challenge the dominance of traditional currencies and payment systems, complicating the West’s ability to maintain its economic and financial hegemony. The implications of such a shift could be far-reaching, altering the way money is perceived and used worldwide.

4.0 Notes

[1] BRICS Russia 2024. Summit 2024. Retrieved October 10, 2023, from https://brics-russia2024.ru/en/summit/

[2] Council on Foreign Relations. (2024). What is the BRICS group, and why is it expanding? Retrieved January 14, 2025, from https://www.cfr.org/backgrounder/what-brics-group-and-why-it-expanding

[3] Ministry of External Affairs, India. (2024.). Kazan Declaration: Strengthening multilateralism for just global development and security. Retrieved January 14, 2025, from https://www.mea.gov.in/bilateral-documents.htm?dtl/38450/Kazan_Declaration__Strengthening_Multilateralism_For_Just_Global__Development_And_Security

[4] Carnegie Endowment for International Peace. (2024, October). BRICS summit: Emerging middle powers in the G7 and G20. Retrieved January 14, 2025, from https://carnegieendowment.org/research/2024/10/brics-summit-emerging-middle-powers-g7-g20?lang=en

[5] BRICS Russia, 2024. Yuriy Ushakov: BRICS truly represents the interests of the global majority. Retrieved January 14, 2025, from https://brics-russia2024.ru/en/news/yuriy-ushakov-briks-na-dele-vyrazhaet-interesy-mirovogo-bolshinstva/

[6] International Monetary Fund. (n.d.). Timeline. Retrieved January 14, 2025, from https://www.imf.org/external/about/timeline/index.htm

[7] Habtoor Research. (2024). BRICS, Russia, and the global financial order. Retrieved January 14, 2025, from https://www.habtoorresearch.com/programmes/brics-russia-global-financial-order/

[8] Mulder, N. (2022, June). The sanctions weapon. Finance & Development. International Monetary Fund. Retrieved January 14, 2025, from

https://www.imf.org/en/Publications/fandd/issues/2022/06/the-sanctions-weapon-mulder

[9] Foreign Policy. (2024, November 18). BRICS currency aims to challenge the dollar: Russia, China, and the future of SWIFT finance amid sanctions. Retrieved January 14, 2025, from https://foreignpolicy.com/2024/11/18/brics-currency-dollar-russia-china-swift-finance-sanctions/

[10] Carnegie Endowment for International Peace. (2024, October). BRICS summit: Emerging middle powers in the G7 and G20. Retrieved January 14, 2025, from https://carnegieendowment.org/research/2024/10/brics-summit-emerging-middle-powers-g7-g20?lang=en#:~:text=As%20the%20fortunes%20of%20the,contesting%20the%20role%20of%20the

[11] Brender, R. (2024, November). Reinhold Brender: Policy brief 364. Egmont Institute. Retrieved January 14, 2025, from

https://www.egmontinstitute.be/app/uploads/2024/11/Reinhold-Brender_Policy_Brief_364_vFinal.pdf?type=pdf

[12] ISPI. (2024). BRICS and MENA: Embracing a multipolar world. Italian Institute for International Political Studies. Retrieved January 14, 2025, from

https://www.ispionline.it/en/publication/brics-and-mena-embracing-a-multipolar-world-191476

[13] World Economic Forum. (2024, November). BRICS summit: The geopolitics of a bloc in transition. Retrieved January 12, 2025, from

https://www.weforum.org/stories/2024/11/brics-summit-geopolitics-bloc-international/#:~:text=The%20BRICS%20economies%20also%20account,to%20the%20International%20Monetary%20Fund

[14] Le Monde. (2023, August 24). Iran, Saudi Arabia, Egypt, UAE, Argentina, Egypt, and Ethiopia set to join the BRICS. Retrieved January 14, 2025, from

https://www.lemonde.fr/en/international/article/2023/08/24/iran-saudi-arabia-egypt-uae-argentina-egypt-and-ethiopia-set-to-join-the-brics_6106146_4.html

[15] Brookings Institution. (n.d.). Understanding China’s Belt and Road infrastructure projects in Africa. Retrieved January 13, 2025, from

https://www.brookings.edu/articles/understanding-chinas-belt-and-road-infrastructure-projects-in-africa/

[16] German Institute of Development and Sustainability. (n.d.). Financing global development: The BRICS New Development Bank. Retrieved January 13, 2025, from https://www.idos-research.de/en/briefing-paper/article/financing-global-development-the-brics-new-development-bank/

[17] BRICS. (2020). BRICS 2020: Strategy for cooperation. University of Toronto. Retrieved from http://www.brics.utoronto.ca/docs/2020-strategy.html

[18] Middle East Council on Global Affairs. (2024, January 13). BRICS summit: Shaping a new geopolitical landscape – Council views. Retrieved from

https://mecouncil.org/blog_posts/brics-summit-shaping-a-new-geopolitical-landscape-council-views/

[19] Foreign Policy. (2024, October 23). Turkey’s BRICS application and its stance on Gaza, Ukraine, and nonalignment. Retrieved from https://foreignpolicy.com/2024/10/23/turkey-brics-application-summit-erdogan-gaza-ukraine-nonalignment/

[20] Ferragamo, M. (2024, December 12). What is the BRICS group and why is it expanding? Council on Foreign Relations. Retrieved from

https://www.cfr.org/backgrounder/what-brics-group-and-why-it-expanding

[21] Bradlow, D. D. (2023). The New Development Bank in Africa: Assessing its role and performance. Global Policy, 10.1111/1758-5899.13310. https://doi.org/10.1111/1758-5899.13310