1.0 Introduction

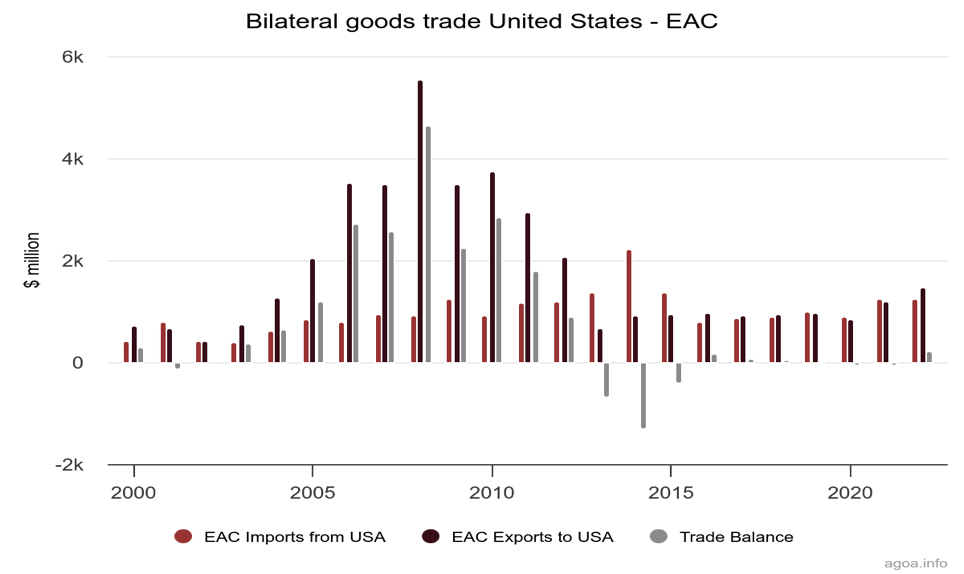

As the African Growth and Opportunity Act (AGOA) approaches its 25th anniversary, there is an urgent need for East African Community (EAC) member states to strategically position themselves to maximize the benefits of this critical trade agreement between Africa and the United States(USA). The AGOA was enacted by the USA in 2000, offering eligible Sub-Saharan African countries duty-free access to U.S. markets for more than 6,500 products.[1] They range from textiles and apparel to footwear, processed agricultural products, minerals, and motor vehicle parts. Though the AGOA has greatly promoted exports and stimulated economic growth for several African states, the program remains one of mixed performance across the continent. The effectiveness of AGOA within the East Africa specifically shows a mixed result.

Countries like Kenya have made significant progress, particularly in sectors like apparel, where exports jumped from USD 55 million in 2001 to USD 603 million by 2022.[2] Meanwhile, neighboring Uganda while under the current ban by the US, faces challenges in benefiting from the Act.[3] In light of this, it is important that EAC member states adopt a forward-looking policy that allows AGOA to continue as a catalyst for economic growth in East Africa. This entails overcoming existing barriers and seizing opportunities that AGOA provides. In this regard, this commentary identifies and offers policy recommendations for addressing existing gaps which impedes the region from realizing the full potential of this trade agreement with a focus on Kenya and Tanzania.

2.0 Leveraging AGOA Through Policy Innovation and Strategic Reforms: A Focus on Kenya and Tanzania

2.1 Streamlining Customs and Trade Processes

Inefficient customs and trade processes hinder Kenya and Tanzania from fully optimizing on AGOA benefits. Although this trade initiative allows duty-free access to U.S. markets, obstacles, particularly at major East African ports, continue to undermine its potential for delivering the intended advantages. The Mombasa port in Kenya, for example, is a core facility for regional trade that has been grappling with chronic delays occasioned by outdated custom procedures and underdeveloped infrastructure.[4] Container dwell times are reported to average between 8 and 12 days, which significantly affects the timeliness in the movement of goods and reduces the competitiveness of Kenyan exports to the U.S. However, the recent 12% growth in container cargo handled at the beginning of 2024 shows some improvements in operational efficiency and proves that such reforms in policy groundwork related to management at the ports are finally starting to pay off.[5]

In sharp contrast, Tanzania’s Dar es Salaam port remains beset by more deep-seated problems of severe congestion and bureaucratic inefficiencies that stretch container dwell time up to as long as 15 days. Delays in modernizing customs systems through the integration of technology has exacerbated existing problems, thus undermining Tanzania’s ability to facilitate smooth trade operations to the US.[6]

To mitigate these challenges, both Kenya and Tanzania must prioritize modernizing their customs processes, particularly through the adoption of electronic customs systems. For instance, Kenya could expand the Kenya TradeNet System, which provides for the electronic processing of trade documents to reduce over-reliance on the paper-based process. Improving interagency coordination is also needed. This can be done by establishing a single window system that facilitates seamless interaction among the various government agencies involved in trade.

Public-private partnerships (PPPs) equally offer a promising avenue for financing and implementing these necessary technology upgrades. Collaborations with technology providers and logistics companies could streamline operations and reduce overall costs. Furthermore, both countries should consider introducing performance-based metrics to continuously monitor and improve customs efficiency.

2.2 Harmonizing Standards and Regulations

The lack of harmonized standards and regulations between Kenya, Tanzania, and international markets presents significant barriers to trade. Kenya’s exports, particularly in the textiles and apparel sector, face challenges in meeting U.S. regulatory standards due to discrepancies in local and international standards. According to the World Bank (2023), non-tariff barriers related to regulatory standards are a major obstacle, with product certification processes often being cumbersome and costly.[7]

Tanzania’s regulatory environment also poses challenges. The country’s standards for agricultural products and manufactured goods frequently diverge from international norms, impacting market access. The Iinternational Trade Centre (ITC) highlights that aligning with international standards can help mitigate these trade barriers and enhance market access (ITA, 2022).[8]

To address these challenges, Kenya and Tanzania need to align their standards with international and U.S. requirements. This involves not only updating national standards to meet international norms but also engaging actively with U.S. regulatory bodies to ensure compliance with AGOA criteria. For example, Tanzania’s recent adoption of the EAC Standards Harmonization Policy is a step in the right direction. Kenya should similarly work towards harmonizing its standards with international practices and explore mutual recognition agreements (MRAs) within the EAC.

Establishing MRAs can simplify the certification process for exporters by reducing the need for multiple certifications. This can lower costs and increase the acceptance of East African products in the U.S. market. Continuous dialogue with international standards organizations, such as the International Organization for Standardization (ISO), can also help ensure that Kenyan and Tanzanian products meet global quality standards.

2.3 Infrastructure and Logistics

Infrastructure deficiencies pose significant barriers to AGOA benefits for Kenya and Tanzania. Both countries struggle with inadequate transport networks and port inefficiencies that directly inflate logistics costs and erode the competitive advantage they should leverage under AGOA. In Kenya, poor road conditions and severe congestion at the Mombasa port contribute to some of the highest logistics costs in the region, which hinder the swift movement of goods.[9] As noted by the World Bank,[10] logistics costs account for a large portion of the country’s GDP, making Kenyan exports less competitive in global markets. The delays caused by insufficient road infrastructure and port inefficiencies impede Kenya’s ability to maximize its AGOA benefits by limiting timely access to U.S. markets.

Similarly, improving Tanzania’s transport and logistics infrastructure, particularly the inefficiencies at the Dar es Salaam port, hinder the potential to optimize trade flows under AGOA.[11] Delays and high transportation costs caused by outdated port facilities and underdeveloped road networks lead to the slow movement of goods, reducing Tanzania’s competitiveness in exporting to the U.S. under the AGOA framework. Recognizing the urgency of these challenges, both countries need to prioritize strategic investments in infrastructure development.

For Kenya, upgrading road networks and expanding port capacities at Mombasa would directly alleviate the congestion and inefficiencies that have undermined the country’s ability to fully benefit from the AGOA framework. In Tanzania, the ongoing expansion of the Dar es Salaam port and the modernization of the central railway line are promising steps that need to be accelerated. Such infrastructure improvements are critical not only for reducing transportation costs and enhancing trade efficiency but also for increasing the competitiveness of exports, allowing both nations to better harness the full potential of AGOA for economic development and trade growth.

2.4 Capacity Building and Technical Assistance

Capacity building is crucial for Kenyan and Tanzanian businesses to navigate complex regulatory environments and fully leverage AGOA. Targeted training and support can significantly enhance firms’ capabilities in meeting export requirements and capitalizing on market opportunities.[12] Furthermore, building a skilled workforce is essential for driving innovation and improving productivity.

Tanzania’s initiatives in capacity building, such as partnerships with international organizations and training programs for businesses, provide a valuable model.[13] Kenya should enhance its capacity-building efforts by investing in training programs that focus on export requirements, quality standards, and market access strategies. Collaborations with organizations like the WTO and ITC can provide the necessary expertise and resources.

Promoting entrepreneurship and supporting small and medium-sized enterprises (SMEs) is also crucial. SMEs often drive innovation and are vital for economic growth. Providing targeted support to these businesses can foster a dynamic and competitive business environment. This support could include access to financing, mentorship programs, and technical assistance to help SMEs meet international standards and expand their market reach.

3.0 Conclusion

An overhaul of non-tariff barriers in Kenya and Tanzania will involve a general policy reform for realization of full potentials of the AGOA framework among the two East African states. Contextually, bridging strategies, would therefore include streamlining of customs and trade processes, harmonizing standards and regulations, infrastructural investments, and developing capacity. The effective implementation of these recommendations will improve trade efficiency and competitiveness, enabling both countries to increasingly realize and optimize the benefits offered by the AGOA framework.

4.0 References

[1] The Impacts of the African Growth Opportunity Act on the Economic Performances of Sub-Saharan African Countries: A Comprehensive Review, 2024.

https://www.mdpi.com/2413-4155/6/1/14#:~:text=The%20African%20Growth%20Opportunity%20Act%20(AGOA)%20represents%20a%20groundbreaking%20piece,trade%20on%20over%206500%20products.

[2] Africa-US trade: Agoa deal expires in 2025 – an expert unpacks what it’s achieved in 23 years. The conversation, 2023. https://theconversation.com/africa-us-trade-agoa-deal-expires-in-2025-an-expert-unpacks-what-its-achieved-in-23-years-217113#:~:text=In%20Kenya%2C%20for%20instance%2C%20the,Africa’s%20most%20diversified%20export%20list

[3] How Uganda Agoa ban impacts East Africa investments. The East African, 2024. https://www.theeastafrican.co.ke/tea/business/how-uganda-agoa-ban-impacts-east-africa-investments-4486292

[4] Ruto order gives Mombasa port an edge over rival Dar. Nation, 2023. https://nation.africa/kenya/blogs-opinion/blogs/ruto-order-gives-mombasa-port-an-edge-over-rival-dar-4323230

[5] Mombasa port to the rescue as congestion hits regional berths. The Star, 2024. https://www.the-star.co.ke/news/2023-12-07-mombasa-port-to-the-rescue-as-congestion-hits-regional-berths/

[6] Clearing system at Dar es Salaam port hit by technical hitches. TradeMark Africa, 2021. https://www.trademarkafrica.com/news/clearing-system-at-dar-es-salaam-port-hit-by-technical-hitches/

[7] Kenya Apparel and Textile Industry. Diagnosis, Strategy and Action Plan, 2023. https://documents1.worldbank.org/curated/en/441761468000939834/pdf/99480-REVISED-Kenya-Apparel-and-Textile-Industry.pdf

[8] Trade Barriers, International Trade Administration. Tanzania Country Guide, 2023. https://www.trade.gov/country-commercial-guides/tanzania-trade-barriers

[9] Infrastructure, Kenya Country Guide. International Trade Administration, 2024. https://www.trade.gov/country-commercial-guides/kenya-infrastructure

[10] Transport Sector Background Note. The World Bank, 2023.

https://documents1.worldbank.org/curated/en/099110923174539500/pdf/P17979202d856600d09d1a099885ec86d8a.pdf

[11] EALA Members Highlight Challenges Affecting Dar Port. Trade Mark Africa, 2024. https://www.trademarkafrica.com/news/eala-members-highlight-challenges-affecting-dar-port-users/

[12] Capacity building as a route to export market expansion: A six-country experiment in the Western Balkans. The World Bank, 2023.

https://thedocs.worldbank.org/en/doc/b91f2e7d881e826a069ef53c380e8fbf-0050022023/original/powerup-paper-24.pdf

[13] Reviving Tanzania’s Regional Leadership and Global Engagement. Priorities for an effective global reset. Chatham House, 2024.

https://www.chathamhouse.org/2024/04/reviving-tanzanias-regional-leadership-and-global-engagement/04-tanzanias-global-engagement.